Student loan income based repayment calculator navient

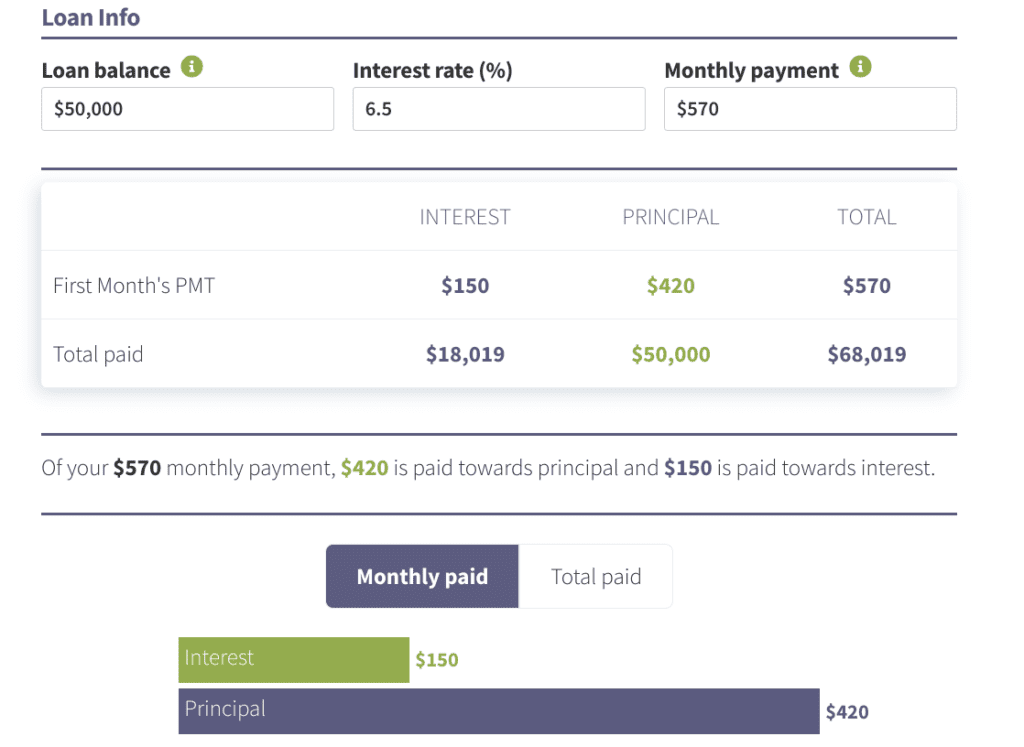

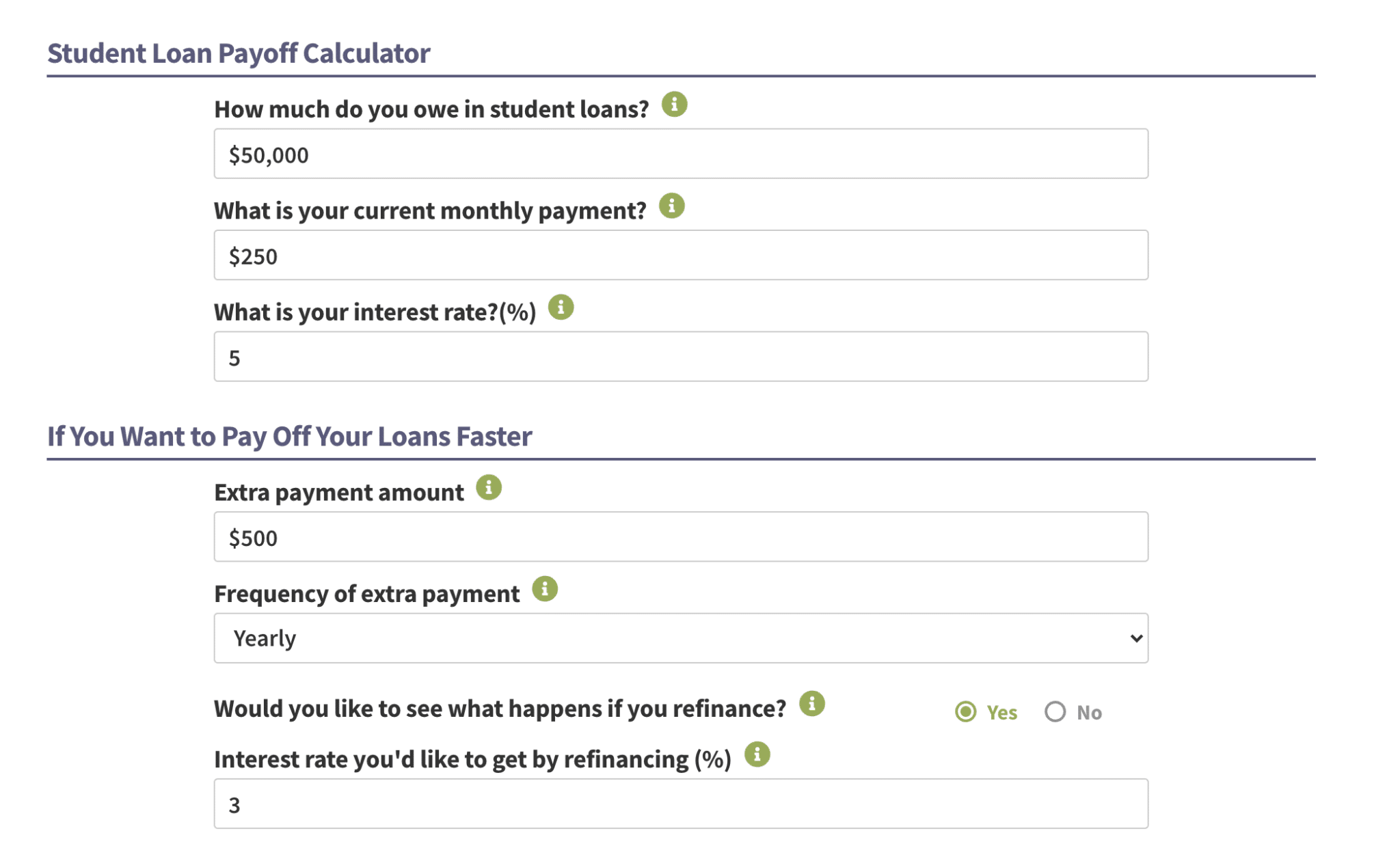

Ad Estimate College Education Expenses With Scholars Edge 529 Plan Calculators. Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved.

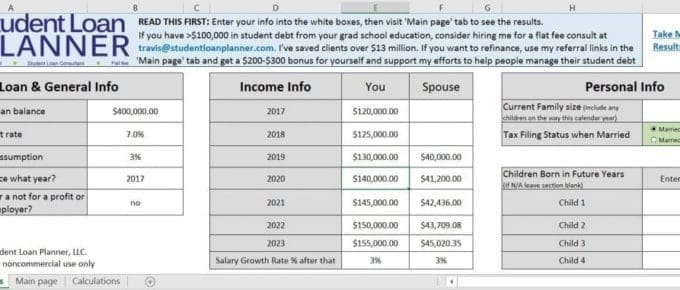

Student Loan Interest Calculator Student Loan Planner

Past periods of repayment deferment and forbearance might now count.

. Start Your Free Pre-Application Online Today. Find the percentage of the debt you owe. Navient launches new student loan calculator to help borrowers plan for faster loan repayment Mar 9 2016 WILMINGTON Del March 09 2016 GLOBE NEWSWIRE -- Calculating expected monthly payments and likely interest to be paid are important factors in determining an effective budget for paying off student loans.

If you are already enrolled in an IDR plan you must recertify your income each year to remain in the plan. Use the application below to apply now or to recertify your plan. Income-Driven Repayment IDR plans can cap your required monthly payments in proportion to your discretionary income.

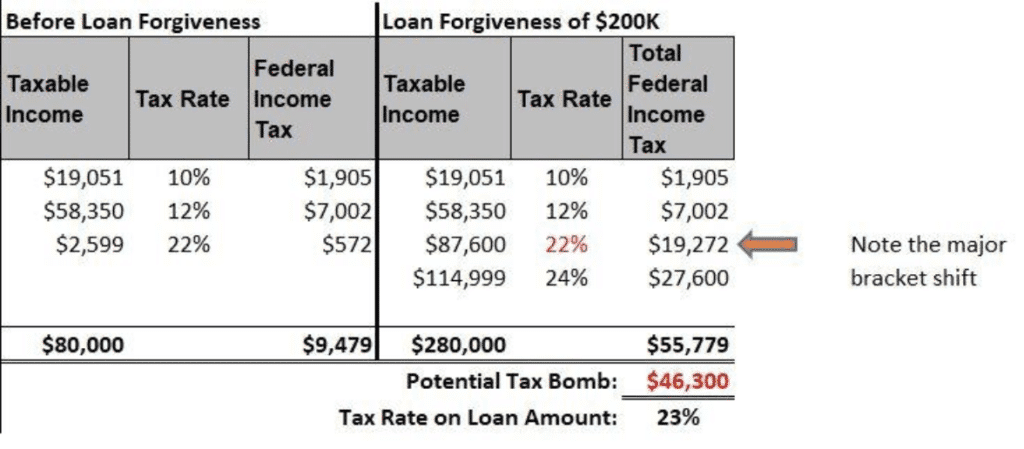

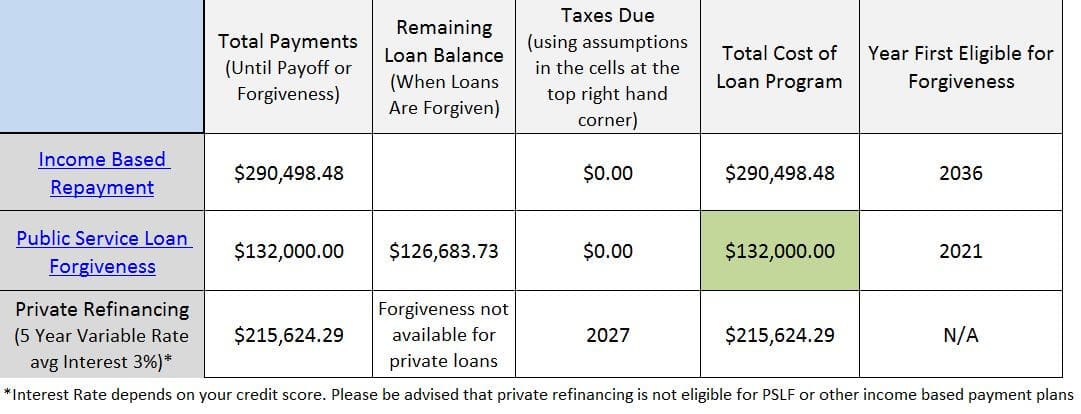

This calculator projects forgiveness at 25 years so the actual forgiven amount could be. The departments proposed rule would forgive loan balances on income-driven repayment plans after 10 years of payments rather than 20 years for borrowers with an original loan balance of. You are eligible for loan forgiveness after 20 or 25 years depending on when you borrowed the money.

They are a great option for student loan borrowers who struggle to pay their monthly payments or for those who just wanna use that extra money elsewhere. After you make 25 years of monthly payments you will have paid 73276 and would receive 51943 in student. 20 or 25 years.

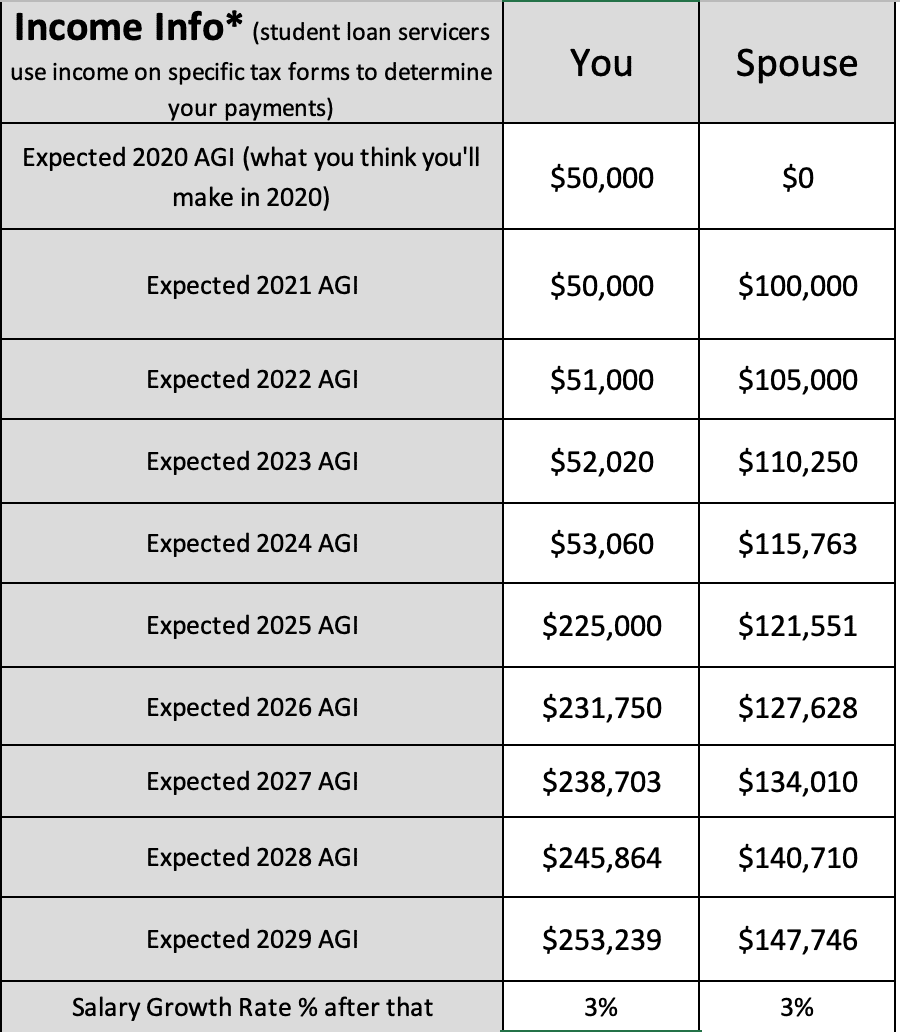

This student loan payment calculator will provide you results on what your income-driven payment should be for your federal student loans. If you have parent PLUS loans you must consolidate your loans to become eligible for an IDR plan. Ad Obama Forgiveness Program - Apply For Income-Based Federal Benefits.

As your income increases so will your monthly payments under IBR. However the forgiven balance is taxable as income at this time. Splash Financial Most Affordable Loan Payment Options for Medical.

If you earn below 150 of the poverty level your required loan. The remaining balance monthly payment and interest rate can be found on the monthly student loan bill. 10 or 15 of discretionary income never more than.

Generally your monthly payments under Income-Based Repayment IBR Pay As You Earn PAYE and Revised Pay As You Earn REPAYE are calculated as 10 or 15 of your discretionary income which is your income minus 150 of the poverty level for your family size and state. All income-driven repayment plans are eligible for loan forgiveness after making your payments for either 20-25 years. Monthly Payments under the Standard Repayment Plan are a minimum of 50.

Your repayment term will be up to 10 years or up to 30 years for consolidation loans. Calculate your combined federal student loan debt. 30000 divided by 80000 is 0375 meaning you.

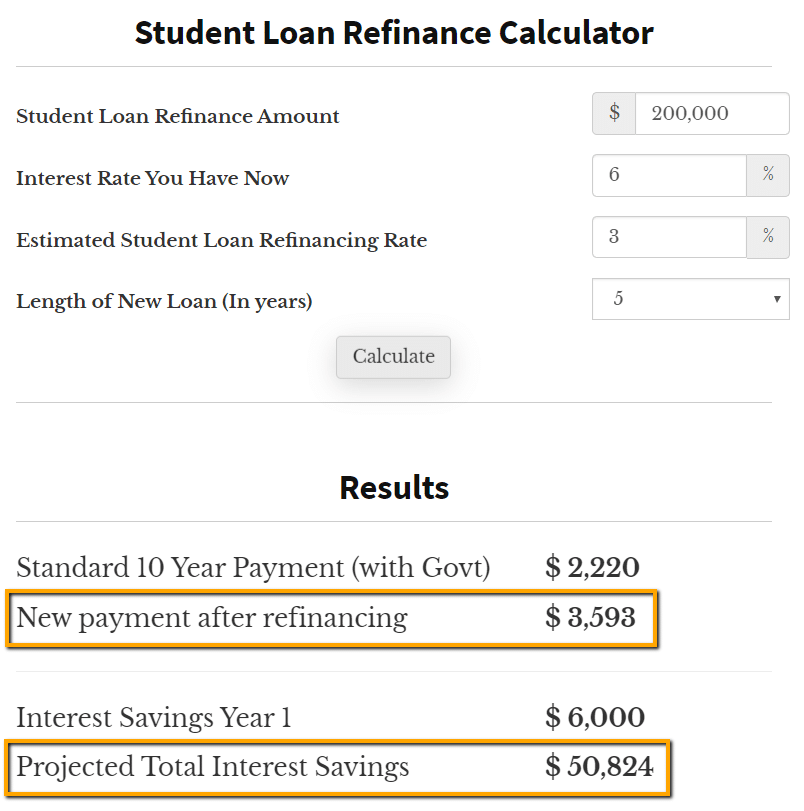

Summary of Moneys Best Student Loan Refinance Companies of September 2022. Fill out your information in the income-based repayment plan calculator below to see what your federal student loan. Investment Management by Principal.

With an annual income growth of 3 your final monthly payment would be 368. Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment. Your 30000 plus your spouses 50000 is 80000.

Student Loan Repayment Calculator. Credible Best Student Loan Marketplace. Income-Driven Repayment IDR Calculator.

Your new monthly payment will be dependent on factors such as income and family size as well as life changes. This plan has a repayment schedule with fixed Monthly Payment Amounts of principal and interest that will be due for the repayment term. Assuming annual income growth of 35 your last monthly payment would be 403 which is -8 lower than your.

Payments are capped at 10 of discretionary income if you received loan money after July 1 2014 and 15 if you received loan money before then. If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment. With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment.

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Income Based Repayment Calculator Includes Biden Ibr Plan

How To Lower Student Loan Payments Credible

Managing Your Account Navient

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

Biggest Mistakes Doctors Make With Their Student Loans In Residency

Everything You Need To Know To Manage Your Navient Student Loans Tun

Student Loan Payoff Calculator Updated For 2022 Student Loan Planner

Student Loan Forgiveness 5 Questions On The Navient Settlement

Income Based Repayment Of Student Loans Plan Eligibility

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

Managing Your Account Navient

How Much Will My Student Loan Payment Be Student Loan Planner

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero